extended child tax credit dates

For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. The maximum child tax credit amount will decrease in 2022 In 2021.

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

13 opt out by Aug.

. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. Child Tax Credit Information from WhiteHousegov Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child between ages 6-17 and 300 per child under age 6. Categories In Child Tax Credit News.

Date of Payment Details. Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for school-age children and. The new Child Tax Credit enacted in the American Rescue Plan is only for 2021.

Heres an overview of what to know. 15 opt out by Aug. Specifically the Child Tax Credit was revised in the following ways for 2021.

Ad Receive the Child Tax Credit on your 2021 Return. Families will receive a maximum of 3600 for each child under 6 for tax year 2021 and a maximum of 3000 for kids 6 through 17. Filed a 2019 or 2020 tax return and claimed the Child Tax.

The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started. IR-2021-153 July 15 2021. The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17.

FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The agency says most eligible families.

The Child Tax Credit has provided significant financial relief to millions of families across the United States who have struggled to stay afloat amidst the. Post date July 8 2022. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to.

File Federal Taxes to the IRS Online 100 Free. The IRS and Department of Treasury announced that the expanded credit will begin being paid out as advanced monthly payments starting July 15 to. With high prices and the ongoing pandemic the 2021 expanded Child Tax Credit CTC can provide critical support.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. Unless Congress takes action the 2020 tax credit rules apply in 2022.

Input Tax Credit Tax Credits Business Rules Reverse

Vinod K Agrawal Associates Ca On Twitter In 2022 Dating Last Date The Originals

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

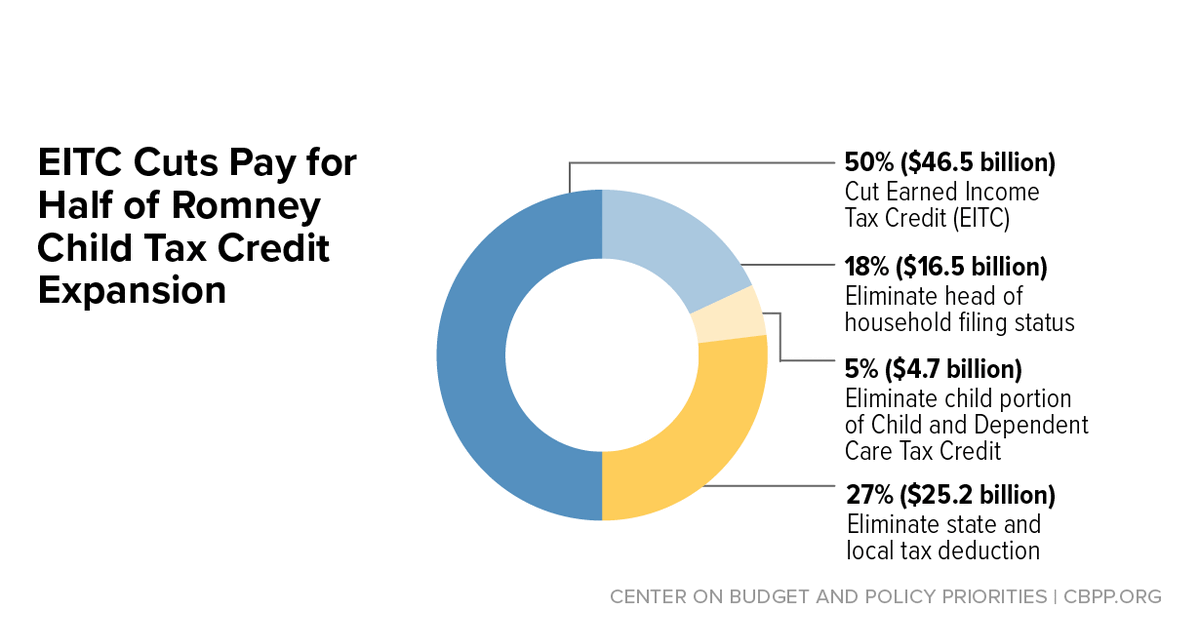

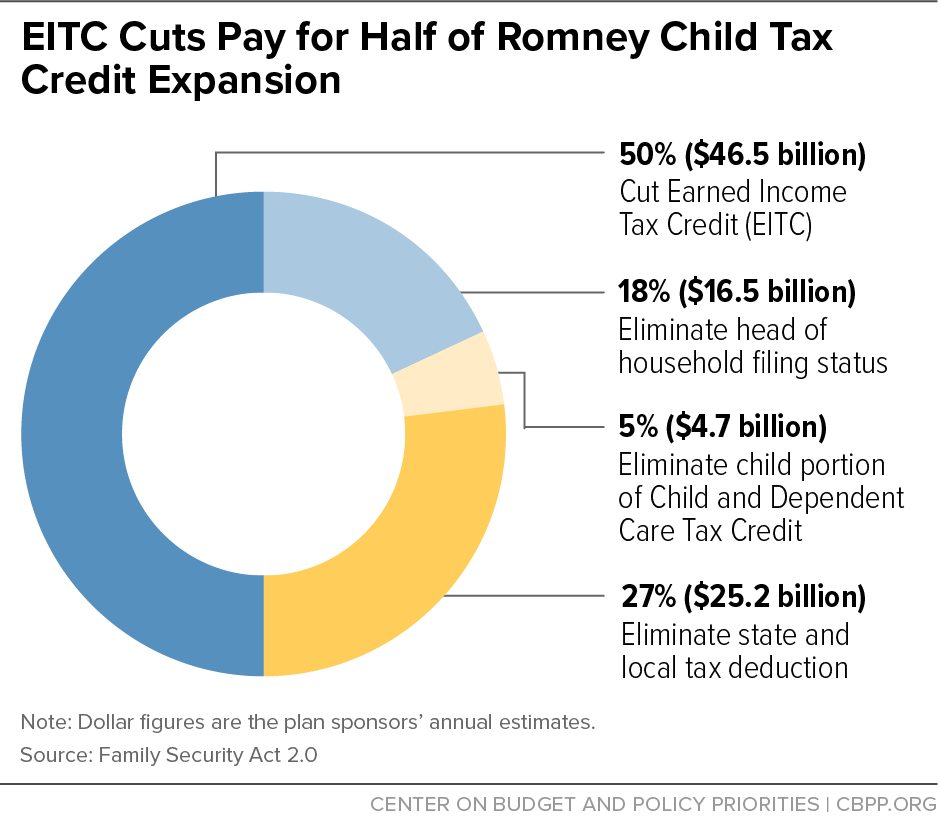

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Gst News Goods And Service Tax Due Date Taxact

Childctc The Child Tax Credit The White House

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2021 Child Tax Credit Advanced Payment Option Tas

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Deadline To Apply For Ct S Child Tax Rebate Is Sunday

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Bra Extends Personal Income Tax Filing Deadline Barbados Today

Free Tax Information In 2022 Estimated Tax Payments Tax Software Filing Taxes

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities